The average price of outsourcing your bookkeeping needs ranges depending on the number of transactions and complexity of services required. A key benefit of Outsourcing is it gives you the ability to customize the services you receive to your bookkeeping needs. Depending on the industry, you might be able to extend your services to include cost accounting for projects and jobs. Because this type of service requires a lot of industry-specific knowledge, you’ll be able to charge a higher rate than on typical bookkeeping engagements.

questions to ask yourself before hiring a bookkeeper

You want to hire a bookkeeper with the requisite qualifications. Freelance bookkeepers often come from different backgrounds, but this doesn’t mean they necessarily offer lower prices for their services. That’s why it’s important to consider a person who has at least a bachelor’s degree. FreshBooks is an invoicing and accounting software for small businesses. Business owners who wish to automate their financial tasks can use some of the latest tools on the market. For example, the process is similar to hiring an in-house bookkeeper but you don’t have to add overhead costs for employees on the payroll.

How Much Should You Be Paying for Bookkeeping Each Month?

Define a package or packages that clearly define what services you will provide for your clients. You could have a basic level of service that comes with a fixed fee, such as weekly journal entries and monthly bank reconciliations. Any add-on services, such as ad-hoc requests, could involve an extra charge or be charged hourly. Data entry is nothing but the procedure to record financial transactions, that is, maintaining a record of what comes in and what goes out of your business.

A fixed monthly rate based on time.

Check out these articles for more tips on client communication and best practices for small agencies.

It will be more work upfront, so you can bill more upfront. It’s reasonable for a new bookkeeper to charge around $40 an hour, but you’ll need to do some research in your area to make sure that is a good starting point. From there, you can raise your rates as you gain more experience, and many top out around $80 or more an hour. In addition, you’ll need to add around 20% on top of salary for benefits and overhead including office space. Accounting software like FreeAgent can help you explain bank transactions in bulk, run reports across your whole client base and set up alerts to notify you that a client’s VAT return is due. If you’re keen to automate more of your admin, here are some tips for getting the most out of your practice’s tech stack.

- Time how long it typically takes you to do your bookkeeping and calculate how much you would normally earn during that time.

- They already trust you and you already know how their business works.

- You’re also learning their business and don’t know exactly what tasks you will be doing.

Meanwhile, the average hourly wage for in-house bookkeepers is approximately $21.10, ranging from $26.85 in Washington to $16.55 in North Carolina. Don’t end up doing more work without getting paid for your services – especially if it’s long-term. The move from an hourly rate, which solely charges from your time, to a fixed fee feels risky at first.

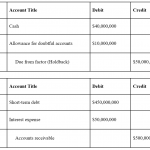

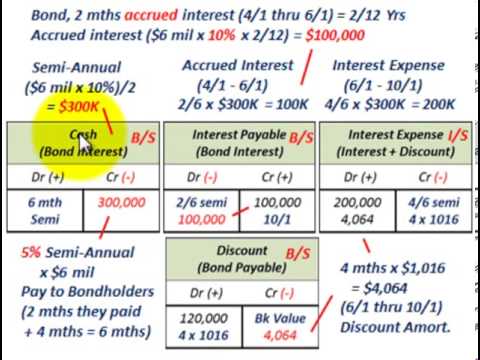

We provide our clients with a modified form of cash basis bookkeeping. With this system, we record transactions as soon as the money has been deposited into your bank or charged to your bank/credit card. If your business is moving into a growth stage, you need to consider https://www.intuit-payroll.org/ graduating to full accrual based accounting, with financial and management reports that help you scale. Typically you will need this level of financial management not only for yourself but for your key stake holders including banks, investors and advisors.

Noticing trends for the different pricing systems that you test is key to establishing the right balance. Asking yourself these questions is vital to knowing main secrets of work with loans payable the right bookkeeping pricing for you. Lessons learned on how top firms grow fast, build stronger teams, and increase profit while working less.

In addition to these basic bookkeeping activities, your costs will be impacted by how your accounting systems, policies and procedures, and reporting needs are set up and administered. Whether you charge by the hour or offer a fixed fee, both are considered competitive pricing. Most bookkeepers who competitively price their services focus on tasks and time.

By the way, educating your clients about the outcomes positions you as an expert instead of a technician. Using our proprietary cost database, in-depth research, and collaboration with industry experts, we deliver accurate, up-to-date pricing and insights you can trust, every time. Tools and advice for accounting business leaders who do more than solve their clients’ day-to-day problems. Firm Forward is a guide for accounting firm leaders looking to add a global team to their business or have already done so.

Add the services which you currently do for free to your list. Clients need a variety of services, ranging from basic to complex. By bundling services together, you separate https://www.kelleysbookkeeping.com/translation-exposure/ your fees from time. This, of course, allows you to charge more without working any additional hours. On the other hand, bookkeepers are the more affordable option.

What I recommend when you’re starting out is to begin with your hourly rate and transition your client into a fixed monthly rate. It’s really hard to figure out what to charge someone without actually doing the work and finding out how much time your client’s account will take you each month. Many times you’ll be discovering things about the business as you get to know your client, and you may even find some issues your client didn’t know were there. Online bookkeeping services typically range from around $200 per month to well over $500 per month if you opt for more frequent reports or back-office add-ons. Depending on the bookkeeping service, costs also rise when your business’s monthly expenses exceed a particular threshold. The decision comes down to whether the time saved is worth the expense.