Most remote QuickBooks Live bookkeepers work from home which means you need a reliable hard-wired internet connection and a landline phone. Intuit will provide a laptop with all the technology and software required to meet your responsibilities. Intuit will also provide a webcam, headset, USB hub, Ethernet cable, backdrop, and VPN token. If you’re interested in being a freelance virtual bookkeeper, you can sign up for freelance marketplace websites to connect with potential clients. Freelance jobs can range from quick temporary projects to long-term employment.

How Intuit helps tax and bookkeeping pros do their best work

- It lets you know how you’re doing with cash flow and how your business is doing overall.

- This, however, isn’t a general reflection of QuickBooks’ customer support, as it still depends on the quality of customer service you receive from the agent assigned to you.

- For example, the app includes built-in mileage tracking, which is crucial for traveling freelancers who claim mileage or car expenses as a key tax deduction.

- Therefore, business owners are required to analyze their business needs before they select any bookkeeping software.

- You know what a bookkeeper does and what their day-to-day responsibilities look like.

If you upgrade to Premium or Elite, you’ll get access to HR tools, such as onboarding checklists and performance tools. Live Expert Full-Service Bookkeeping doesn’t include sending invoices, paying bills, or management of inventory, accounts receivable, or accounts payable. The service doesn’t include financial advisory services, tax advice, facilitating the filing of income or sales tax returns, creating or sending 1099s, or management of payroll.

Is QuickBooks Live Bookkeeping Right for You or Your Business?

When comparing services, ensure you’re pricing out all the features you need, including add-on services like tax prep, payroll and HR. If you’re considering a bookkeeping service that runs on QuickBooks or Xero, include the cost of that software, too. Take advantage https://www.intuit-payroll.org/ of product demos and introductory calls to find the right service. If you haven’t always been diligent about your financial record-keeping, most bookkeeping services will go through your old receipts, invoices and bank statements to bring your books up to date.

What’s your online bookkeeping services budget?

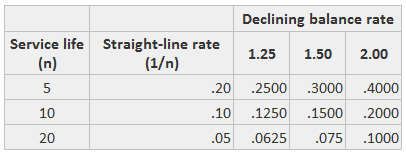

Other add-ons include inventory management, payroll and 1099 support. QuickBooks Online is the most versatile and well-rounded of the QuickBooks suite of products. Since it’s cloud based, QuickBooks Online is easy to access from any phone, tablet, or laptop. Simply put, the best accounting software is one that suits https://www.simple-accounting.org/how-to-calculate-straight-line-depreciation-4/ your unique needs. We offer flexible accounting plans to fit businesses small and large, across all industries, with integrations like payroll, time-tracking, and payments to help you grow efficiently when you’re ready. Some bookkeeping services can provide a full suite of bookkeeping, accounting and tax services.

Best Accounting and Bookkeeping Apps for Small Businesses

Either you are a bookkeeper which is employed by the company or you are a CPA that provides booking services. The inventory management and job costing features are more robust in QuickBooks compared to QuickBooks Online. Those who want to take their accounting on the go will appreciate the mobile app. It brings most of the features of the online platform, plus it enables mileage tracking and receipt capture for quick and convenient recordkeeping. QuickBooks Pro Plus was QuickBooks’ least expensive and least customizable desktop-based plan.

How do I get QuickBooks Online for free?

It also opens up the possibility of becoming a remote QuickBooks Live bookkeeper with Intuit. The Certified Bookkeeper (CB) program from the AIPB requires you to be a working bookkeeper or have at least one year of accounting education. The program includes self-teaching workbooks that prepare you to pass the CB exam.

This certificate prepares you to become a bookkeeper for public accounting, private industry, government, and nonprofit organizations. Once you have a few years of experience in bookkeeping, you might seek additional training to become an accountant or pursue another business-oriented role. Even if you aren’t planning on growing any time soon, you need to have a sense of how much money is coming in versus what is going out. Consider using one of the best bookkeeping services to make managing your books a breeze. At the end of the accounting period, take the time to make adjustments to your entries.

Making sure transactions are properly assigned to accounts gives you the best view of your business and helps you extract the most helpful reports from your bookkeeping software. Broadly, a bookkeeper’s job is to manage the books by keeping track of day-to-day business finances. Bookkeeping professionals have their own expertise based on the types of businesses and industries they serve. Not all versions of QuickBooks offer multiple plans or make it simple to move your business from one product to another. If you think you’ll need more advanced features in the future, it’s important to make sure you choose an option that can accommodate those needs.

You can find services for as little as $20 per month while others run thousands per month. For additional features, these were elements that fell into the “nice-to-have” category that not all software providers offered, either as part of their regular plan or as a paid add-on. Both kinds of features combined to account for 60% of our total score.

QuickBooks’ other cloud-based product, QuickBooks Self-Employed, focuses on freelancers and contractors who want to maximize end-of-year tax-write offs. It works best for self-employed business owners who file their taxes with TurboTax, another Intuit product. It might work well for some big businesses interested in industry-specific software and good customer service, but that’s about prepaid insurance complete guide on prepaid insurance it. For example, the app includes built-in mileage tracking, which is crucial for traveling freelancers who claim mileage or car expenses as a key tax deduction. The app also scans receipts and tracks expenses, which the software then sorts by tax write-off category. Plus, QuickBooks Self-Employed syncs with TurboTax (which is also owned by Intuit) to make tax filing a little simpler.

Online bookkeeping services typically range from around $200 per month to well over $500 per month if you opt for more frequent reports or back-office add-ons. Depending on the bookkeeping service, costs also rise when your business’s monthly expenses exceed a particular threshold. The decision comes down to whether the time saved is worth the expense. QuickBooks Live Bookkeeping is real-time, live bookkeeping support from a QuickBooks-certified bookkeeper (also known as a QuickBooks ProAdvisor). Usually, bookkeeping software has monthly subscription fees and also offers free trial periods.

Use a free trial or ask QuickBooks for a software demo if you’re stuck between products. Bookkeepers are responsible for recording financial transactions related to the business. While most bookkeepers work with businesses, some individuals may also choose to hire a bookkeeper to track personal finances. You can cancel your QuickBooks Live plan or upgrade from Live Expert Assisted to Live Expert Full-Service Bookkeeping at anytime. To downgrade from Expert Full-Service Bookkeeping, you may need to wait until the end of your current subscription billing period. Flat rate of $190 per month is more affordable than other bookkeeping services.

A bookkeeper — even if you are investing several hundred (or even several thousand) dollars per month — can save you money. Let’s look at some of the ways that a bookkeeper can have an impact on a company’s bottom line. This course is completely online, so there’s no need to show up to a classroom in person. You can access your lectures, readings and assignments anytime and anywhere via the web or your mobile device. Gain the professional skills you need to succeed in the bookkeeping field. See website for more details.[1] QuickBooks Live Expert Assisted[2] QuickBooks Live Expert Assisted requires QuickBooks Online subscription.